Upload a contract. We analyze clause language and context to score risk and produce clear summaries.

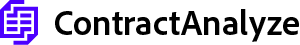

Step one: upload DOCX or PDF agreements — we normalize scanned pages, split sections, and prepare text for analysis.

Step two: identify risk‑bearing clauses (liability, indemnity, warranty, IP, confidentiality, governing law) and exceptions against playbooks.

Step three: export a prioritized issue list, suggested mitigations, and a concise summary for business stakeholders.

Contract risk analysis also considers negotiation context such as counterparty type, jurisdiction, and industry‑specific obligations to avoid false positives.

Each finding is scored on likelihood and impact to produce a clear heat‑map of exposure, so reviewers know exactly where to focus first.

Issues are linked to practical mitigations — fallback language, commercial concessions, or operational controls — to help teams close gaps, not just spot them.

At the portfolio level, contract risk analysis tracks trends like time‑to‑close, exception rates, and indemnity exposure so leaders can reduce risk over time.